Investors may choose from 24 model portfolios of mutual funds or 12 model portfolios of ETFs. Leveraging etfs for tax managed index strategies offers a more streamlined experience for both advisors and clients.

Tax Efficient Choices For Equity Investors Blackrock

Tax-Managed Strategy key features.

. Ad Learn How Bank of America Private Bank Can Help You Explore Alternative Investment Options. Invest In Equity Strategies That May Offer A Better Way Forward. All strategies demonstrate value added by tax management at the 10-year horizon.

Each beta-1 strategy captures at. Its a separately managed account that requires a 200K minimum and charges an. Make use of layered tax management strategies including tax-efficient allocations after-tax portfolio.

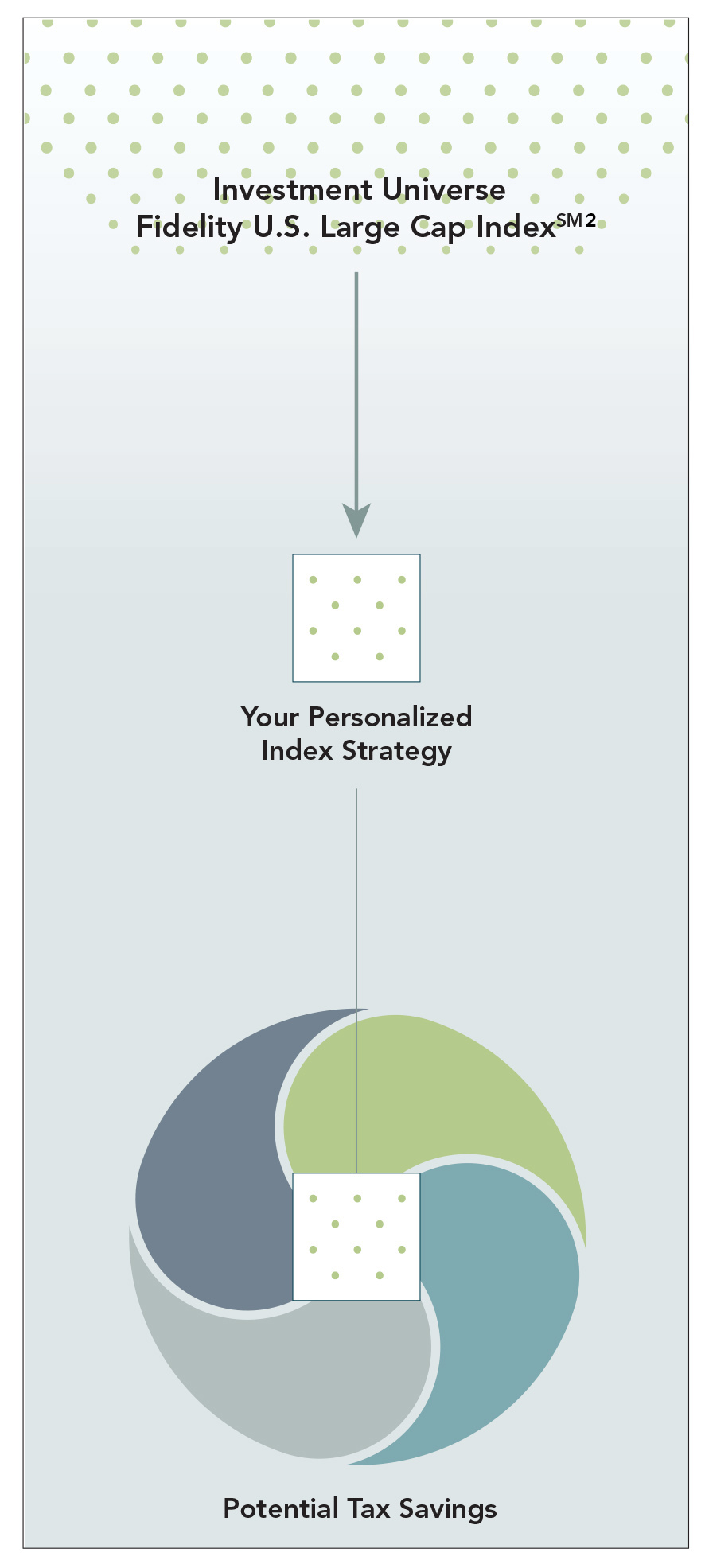

Fidelity Tax-Managed International Equity Index Strategy is a separately managed account SMA that seeks to pursue the long-term growth potential of international large-cap stocks and deliver enhanced after-tax returns. Explore our tax managed funds and model strategies designed to maximize after-tax returns. KOSPI performance year-to-day the former is up 25 while the latter is actually down 05.

Has anyone used the Fidelity Tax-Managed US. Potential for long-term growth This direct index strategy seeks to deliver the long-term growth potential of US. To plan with an advisor explore the Fidelity Tax-Managed US Equity Index Strategy or the Fidelity Tax-Managed International Equity Index Strategy Of course this strategy isnt right for everyone.

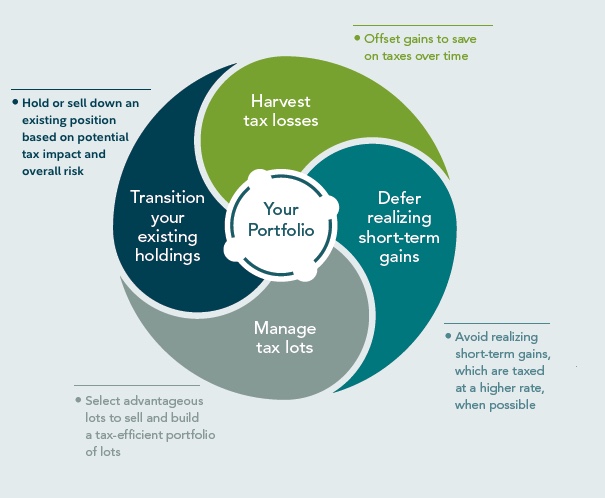

To help manage the impact of taxes the Tax-Managed ETF Strategies uses some of the following techniques. Ad Invest in SMAs that seek to deliver after-tax performance through tax-loss harvesting. Purchasing municipal fixed-income ETFs to create tax-exempt income.

Schwab offers two managed investment programs. Large cap equity fund underperformed its benchmark1 for the quarter as poor stock selection in the technology sector specifically within the software and. 1301 Second Avenue 18th Floor Seattle WA 98101.

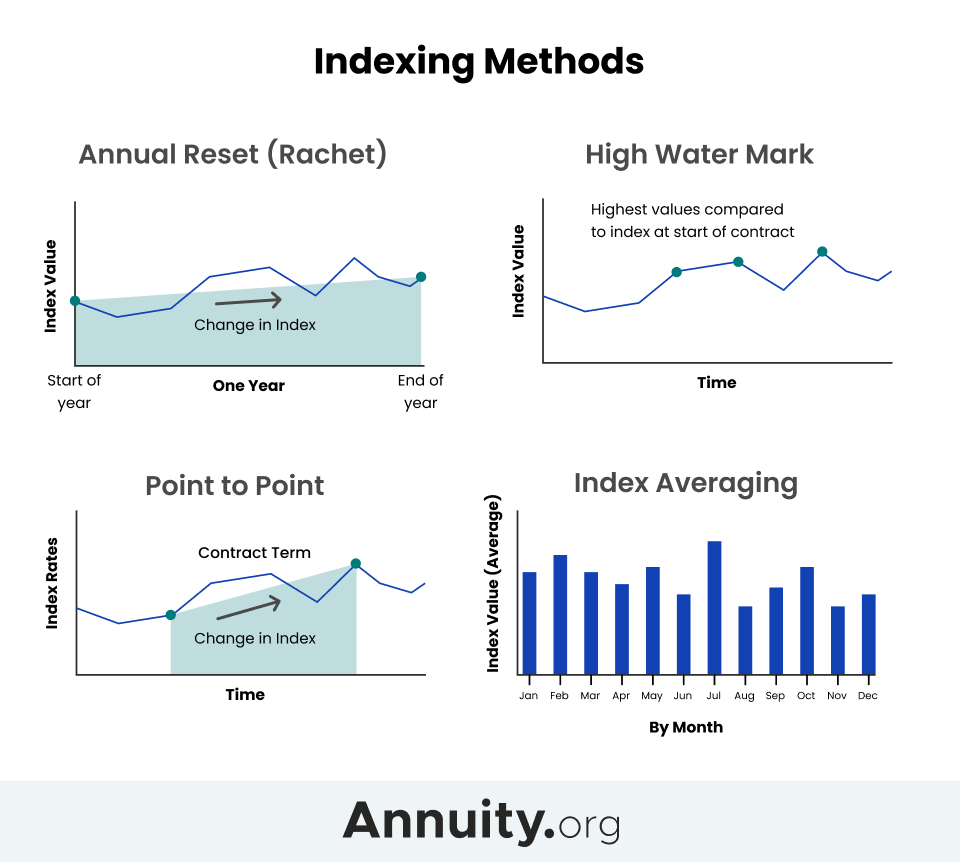

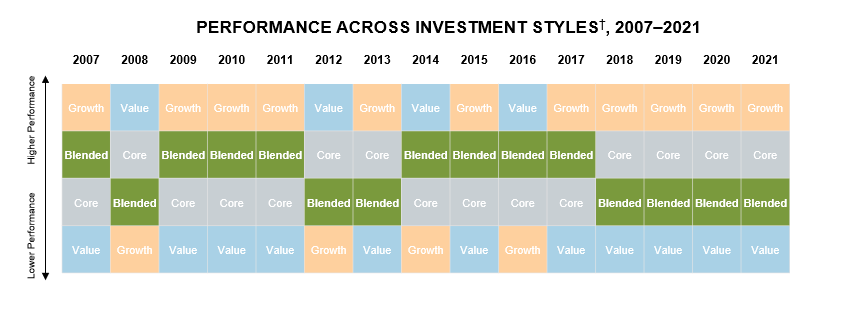

Comparing for example NASDAQ vs. Conversely index exchange-traded funds ETFs seek to track the performance of an index which generally lends to higher tax efficiency. Many mutual fund companies offer tax-managed funds that hold a variety of different assets such as balanced funds international funds small cap funds and others.

The Tax-Managed Equity Growth Model Strategy seeks to provide on an after-tax basis high long-term capital appreciation. The SP Global Infrastructure Index provides liquid and tradable exposure. Some Tax Managed Strategies offered by Frontier Asset Management are appropriate for use at the heart of a clients portfolio while others are complementary and help round out an investment portfolio.

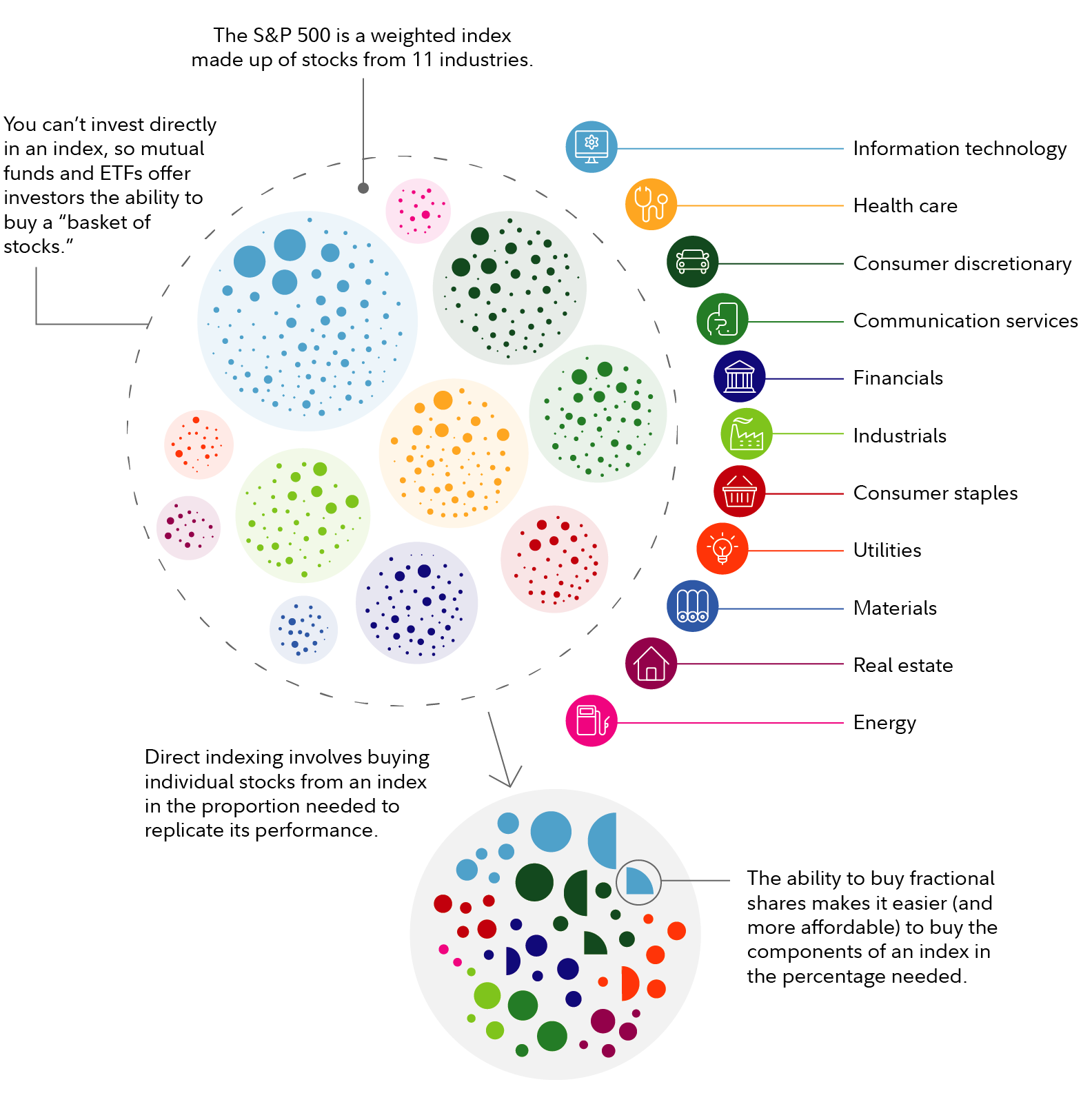

Annual management fees start at 090 for the first 100000 in the account and incrementally decrease for assets above 100000. Tax-managed equity indexing Investors often focus on fees but in many cases taxes have a greater impact on bottom line investment returns. Tax-managed separately managed accounts SMAs focus on adding to after-tax returns by seeking to generate tax losses that offset taxable gains from other assets in the portfolio a practice known as creating tax.

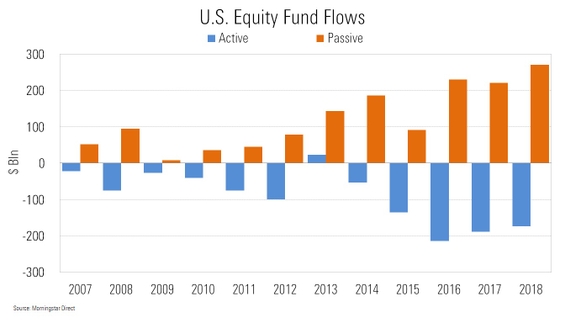

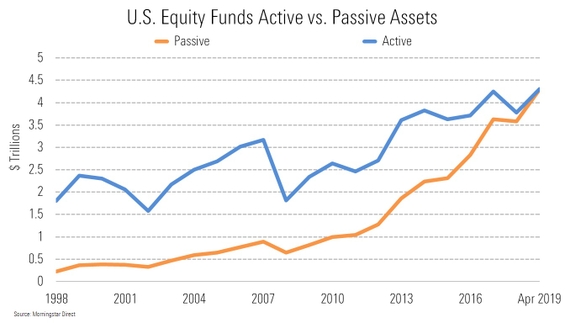

It still requires a sufficient amount of capital to implement effectively even with fractional shares trading capabilities. Recently our tax-managed equity TME team worked with a wealth manager to transition a 3 million client portfolio comprising nine stocks into a well-diversified TME portfolio targeting the SP 1500 index portfolio. Passive is defined as being an index fund as reported by Morningstar or part of an ETF Category.

Tax-managed funds enable investors to control when they realize capital gains such as during a low income tax period when their tax rates will be lowest. Incremental after-tax active return range from 150 per year for Quality to 216 for the index strategy which consistently had the highest average tax alpha. Tax-managed separately managed account SMA strategies seek to track index performance before taxes but outperform after taxes using techniques not available with traditional mutual funds or ETFs.

Schwab Managed Portfolios require initial investments of 25000. Work with experts to improve productivity. 40 FTSE Nareit Equity REITs Index 30 SP Global Infrastructure Index 30 SP Global Natural Resources Index.

We can blend indexes into 200 possible custom benchmarks to meet your clients goals. Tax-Managed ETF Strategies use different techniques designed to help reduce your tax liability. Ad PIMCO Offers An Array Of Strategies Across Regions Market Caps And Styles.

In the past year US market outperformed by far pretty much everything else including the Japanese Nikkei the Korean KOSPI and the EU DAX etc. In this case the main concern was minimizing the realization of the 13 million of unrealized gains embedded in the portfolio. What youll receive with the Fidelity Tax-Managed US.

Controlling portfolio turnover levels to minimize capital-gain recognition. Ad Certent Equity Management is all you need to manage report on equity compensation. Morningstar broad category US Equity largemidsmall VBG which includes mutual funds and ETFs and multiple share classes.

The beta-1 strategies have significantly higher tax alphas than the lower-risk strategies. The FTSE Nareit Equity REITs Index is a free-float adjusted market capitalization-weighted index of US. Simplify streamline cap table management.

Direct investing isnt a new strategy. Tax-Managed Model Strategy returns. Schwab SP 500 Index which has a Morningstar Analyst Rating of Gold also has fine long-term tax-efficiency numbers as does the Silver-rated DFA US.

Active tax management Your account will be managed on an ongoing basis where one or a combination of tax-smart investing.

Fidelity Tax Managed Us Equity Index Strategy Fidelity

Indexed Annuity Pros Cons Fixed Index Equity Index

Tax Efficient Choices For Equity Investors Blackrock

A Look At The Road To Asset Parity Between Passive And Active U S Funds Morningstar

A Look At The Road To Asset Parity Between Passive And Active U S Funds Morningstar

0 comments

Post a Comment